Probate nz is the formal name given to the process of proving the validity of a deceased’s will and confirming who has authority to administer the deceased’s estate.

A grant of probate is made by application to a branch of the High Court called the Probate Registry in Wellington. Once granted, it gives the executors the authority to deal with the deceased’s estate – essentially, to gather in any assets, pay off any debts and to distribute the assets in accordance with the deceased’s wishes.

When is probate required?

Probate in NZ is required whenever the deceased owned land or any one asset valued over $15,000. Estates valued at less than $15,000 may be eligible for the small estates exemption, which means probate is not required.

This means, for example, if the deceased’s only assets were $30,000 spread across 3 separate bank accounts: ANZ ($10,000), Westpac ($10,000) and BNZ ($10,000), then probate would not be required as each is less than $15,000. However, if instead the deceased held the $30,000 all in the ANZ account, then probate would be required as the sum exceeds the threshold.

How to apply for probate nz?

The executor(s) usually apply for probate. One of the first jobs is to track down the original will as this is required to be sent with the application. Often the solicitor who prepared the will retains the original for safekeeping, but this is not always the case.

The executor(s) don’t have to instruct a lawyer to prepare the application for probate, but most commonly they do. Assuming the will is valid, the application is not particularly complicated but the Probate Registry does have very specific requirements for the issues which need to be covered and also for the wording which needs to be used. It is for this reason that many applications are rejected by the Probate Registry, and which only causes further stress and delay.

A typical probate application comprises of the following:

- application notice (form PR1AA)

- executor affidavit in support (form PR1)

- any additional affidavits (e.g. if the executor is unable to prove death)

- probate in common form (& copy probate)

- original will

- court fee

Application notice

The application must name the executors in the same order in which they appear in the will, including details such as place of residence and occupation. It also needs to cover any changes of name from those in the will. The grounds need to be confirmed, most commonly that the applicants are the executors named in the will. The application notice can be viewed here.

Affidavit

There are various issues which need to be addressed in the executor’s affidavit. This is the evidence in support of the probate application and so it is important to cover all the relevant bases to avoid the application being rejected. The affidavit can be viewed here.

In straightforward cases the affidavit may only be relatively short (6 or 7 paragraphs), but in other cases where executors may have died before the deceased, name changes, divorces/separations etc, the affidavit can be considerably longer.

In all cases the death must be proved. This is usually done by the executor confirming the first correct statement from the options provided: i) they were present when the deceased died; ii) they attended the funeral; iii) they saw the deceased’s dead body; or iv) by producing the death certificate.

The executor(s) must also confirm their undertaking to the court to execute the will.

The affidavit must be sworn or affirmed by the executor(s). Note the original will needs to be referred at the time of swearing the affidavit. If there’s more than one executor and they are swearing the affidavit at different times, the original will needs to be produced when each executor swears the affidavit.

Probate in common form

This is the court order known as ‘probate’ which is stamped (or sealed) by the Probate Registrar. This is also the piece of paper which confirms the executor’s authority to deal with the deceased’s estate. A copy of the will needs to be attached.

How long does probate take?

The general rule of thumb is 6-8 weeks. If the Probate Registry is particularly busy or they have any queries about the application then it can take longer. This is important to bear in mind as it can cause delay to things like selling property as probate is required for the transfer of title.

What does the Probate Registry check?

The Registrar will check all of the details provided are consistent and that relevant protocols and procedures have been observed.

Of course the evidence needs to support the application and also explain any irregularities. This may mean in certain circumstances more than one affidavit is required.

The Registrar will also check that the will is valid and also that there is no evidence to suggest that any testamentary documents are missing or appear to have become detached from the will. For this reason things like staples or pins should not be removed or disturbed – this is particularly relevant when it comes to copying or scanning the will – don’t remove staples as the holes may suggest a document has become detached.

Requirements for a valid will

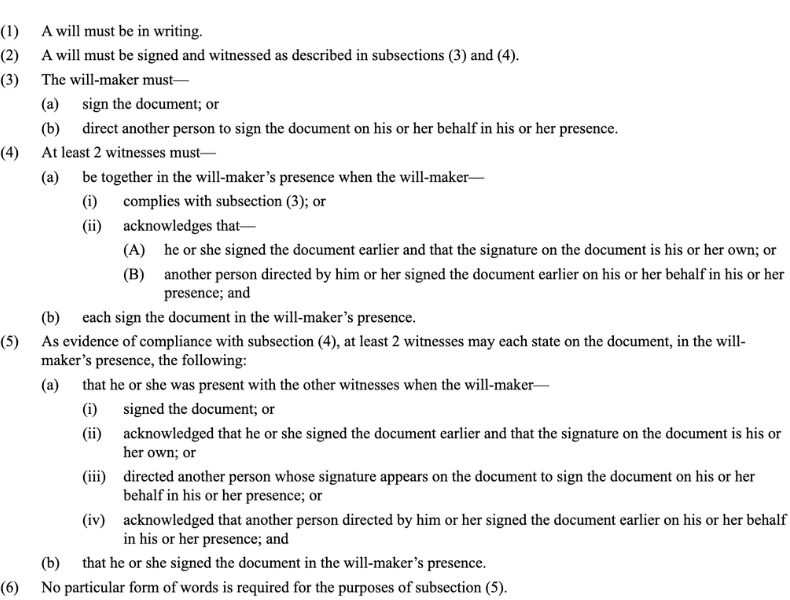

The formal requirements for a valid will are set out in s11 of the Wills Act 2007:

How much does probate cost?

The court fee is currently $200. As noted above, if the executors are willing and able then they don’t have to instruct solicitors to make the probate application, but legal input is helpful.

It is not unusual to hear of lawyers charging over $1,000 or even $2,000 plus GST to prepare a probate application. In general terms, the more complicated an application the longer it will take, and therefore the more it will cost. Equally, if the application is straightforward, the writer does not consider that an application should ever cost more than $1,000 plus GST and court fee, at the most.

Neither is there any obligation for the executor to use the solicitor holding the original will for the purposes of the probate application. The application can be prepared by any lawyer familiar with this area from sighting a copy of the will. Once probate is granted the executor can decide if it is appropriate to instruct the lawyer that held the original will to undertake the legal work administering the deceased’s estate (such as selling any property etc).

It often makes sense if the solicitor has known the deceased and is familiar with their affairs for them to undertake the subsequent legal work administering the estate. But this work is a separate step from the application as it is undertaken once probate has been granted and received back from the court.

Whatever the executor decides to do, it is advisable to ask the lawyer for an estimate of the likely fees.

How long after probate can funds be distributed in NZ?

It really depends on the complexity of the estate and types of assets involved, but in general most estates should be distributed within 6 months from the grant of probate.

The executors have a duty to gather in the assets and to pay off any creditors. The potential risk for the executor is if they distribute the assets only for a creditor to come out of the woodwork – in those circumstances the executor could be on the hook if the assets have been distributed prematurely.